Gamified Rewards: The Future of Loyalty Programs in Crypto

Loyalty programs have been around for decades, offering rewards to customers who continue to do business with a certain company. However, these traditional loyalty programs have become stagnant and lack innovation. With the rise of cryptocurrency and blockchain technology, there is an opportunity to revolutionize loyalty programs through gamification. What

Gamified Rewards: The Future of Loyalty Programs in Crypto

Loyalty programs have been around for decades, offering rewards to customers who continue to do business with a certain company. However, these traditional loyalty programs

Avoiding Rug Pulls In The World of Crypto: Tips and Tricks

The cryptocurrency industry is filled with genuine use cases, innovative

Moonrig Mondays: Master the Market Before the Week Begins

Mondays aren’t just for catching up—they’re for getting ahead.In the

Are A.I Agents The Next Crypto Trend?

With the rise of blockchain technology and cryptocurrencies, there has

Layer 1 Blockchains vs Layer 2 Solutions: Understanding the Differences

In the world of blockchain technology, there are many different

Avoiding Rug Pulls In The World of Crypto: Tips and Tricks

The cryptocurrency industry is filled with genuine use cases, innovative technologies and exciting opportunities for investors. However, with the increasing popularity and value of cryptocurrencies,

Moonrig Mondays: Master the Market Before the Week Begins

Mondays aren’t just for catching up—they’re for getting ahead.In the fast-paced world of Web3, a well-timed decision can make all the difference. That’s why Moonrig

Are A.I Agents The Next Crypto Trend?

With the rise of blockchain technology and cryptocurrencies, there has been a lot of speculation about which emerging technologies will dominate the market in the

Layer 1 Blockchains vs Layer 2 Solutions: Understanding the Differences

In the world of blockchain technology, there are many different layers and solutions that make up the overall ecosystem. Two of the most commonly discussed

Is Mainstream Adoption of Cryptocurrencies Inevitable?

Inevitability is a bold concept. It suggests that something is bound to happen, regardless of any obstacles or challenges. When it comes to cryptocurrencies, this

Why Tracking Crypto Market Trends is Crucial for Successful Investing

Cryptocurrency has seen a dramatic rise in popularity over the past decade, with more and more people investing in this digital form of currency. With

Why High Net Worth Individuals and Institutions are Flocking to Crypto Investments

From Bitcoin to Ethereum, cryptocurrency has been gaining widespread attention and adoption in recent years. While the technology behind these digital currencies may seem complex,

The Importance of Privacy in Crypto Transactions and How to Achieve It

A common misconception about cryptocurrency is that it provides complete anonymity and privacy for its users. While this may be partially true, the reality is

Is Mainstream Adoption of Cryptocurrencies Inevitable?

Inevitability is a bold concept. It suggests that something is bound to happen, regardless of any obstacles or challenges. When it comes to cryptocurrencies, this

Bitcoin’s New All-Time High (What This Means for Investors)

As of March of 2024, Bitcoin has reached a new all-time high of $73,835.57 per Bitcoin. With the halving fast approaching, many investors are wondering

Will Bitcoin Become The Ultimate Form of Collateral?

What’s a common strategy that wealthy individuals deploy to remove the need to sell their assets for cash? Using these assets as collateral. Collateral is

Is Crypto The Answer To Financial Inclusion?

You’re probably familiar with cryptocurrency, such as Bitcoin and Ethereum, but have you ever considered its potential impact on financial inclusion? Although first-world countries have

Addressing Cross-Border Payment Challenges with Blockchain Technology

The promise of blockchain technology has long been hailed as the solution for many cross-border payment challenges. With its ability to create a secure, decentralized

Is Ethereum Still the King of Smart Contracts?

It’s no secret that Ethereum is known as the king of smart contracts. With its robust infrastructure and large community, it has been the go-to

Why NFTs Are Better Than Memorabilia

An alternative asset that is often overlooked is collectables and memorabilia. These can range from sports cards, comic books, and even movie props. However, with

Understanding On and Off Ramps in the Crypto World

Transitioning from fiat currencies to cryptocurrencies can be confusing for many people. One of the most important concepts to understand when entering the crypto world

How Crypto Is Making Its Way Into The Sports Industry

Crypto is often thought of as only a financial disruptor, but it’s also making its way into the sports industry. From NFTs as collectables to

Exploring Decentralized Exchanges: Pros and Cons for Crypto Traders

The promise of decentralization has always been alluring for tech enthusiasts, and the financial world is no exception. With the rise of cryptocurrencies, decentralized exchanges

Understanding Cryptocurrency Trading Pairs: A Beginner’s Guide

Cryptocurrency trading pairs are a fundamental aspect of the cryptocurrency market. In simple terms, a trading pair is a combination of two different cryptocurrencies that

The Rise of Altcoins: Exploring New Opportunities in the Crypto Market

The cryptocurrency market has been making waves in the financial world for quite some time now. What started as a niche movement has now exploded

Why Diversifying Your Crypto Portfolio Can Lead To More Profits

In times of forecasted bull runs for the cryptocurrency market, having a diversified portfolio can prove to be extremely beneficial. Diversification is defined as the

Crypto Abbreviations, Terms and Their Meanings

When doing your own research (DYOR) you might come across a number of abbreviations that are commonly used in the world of cryptocurrency. These can

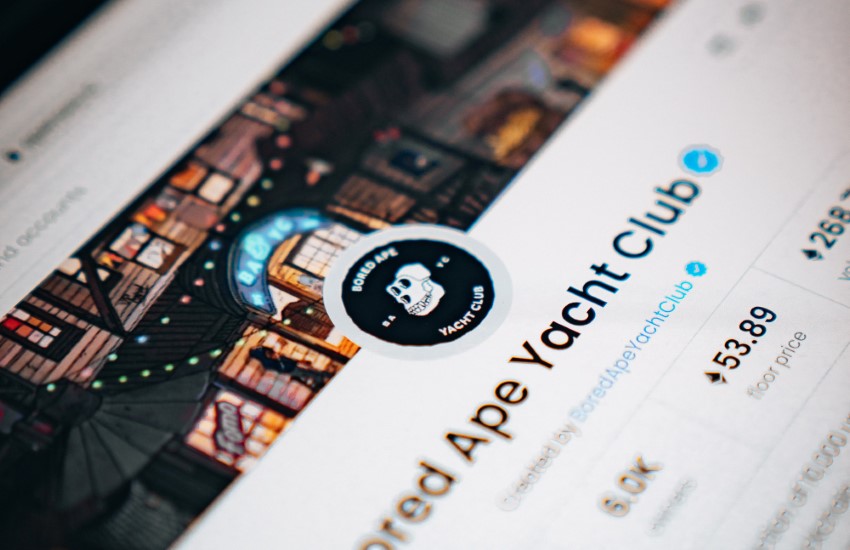

How NFTs Create Stronger Communities

Communities are a core component of our social fabric. They bring people together with common interests, values and goals. Throughout history, communities have been formed

The Future of NFTs: Predictions and Possibilities

From staggering highs to crashing lows, the world of non-fungible tokens (NFTs) has been a whirlwind in recent months. These unique digital assets have dominated

4 Unique Uses Cases of NFTs For Brands

NFTs, or non-fungible tokens, have taken the world by storm in recent years. These unique digital assets are revolutionizing the way we think about ownership

Why Investing With Crypto Ideologies Is Dangerous

From PoW to PoS, there are many different ideologies surrounding cryptocurrency and its technology. While investing in cryptocurrency can be tempting due to its potential

The Rise of Crypto Art: How Artists are Embracing NFTs

Art has been a part of human history for centuries, with artists using various mediums to express themselves and showcase their creativity. However, with the

What Is The Virtual Real Estate Market?

The metaverse is the next frontier of real estate. With virtual reality technology advancing at a rapid pace, the virtual real estate market is becoming

How NFTs Are Revolutionizing the Gaming Industry

NFTs (Non-Fungible Tokens) have been making headlines in the world of cryptocurrency and blockchain technology. These unique digital assets are changing the way we think

The Importance of Layer 2 Solutions for The Scalability of Cryptocurrencies

Critics of blockchain technologies often point out the fact that cryptocurrencies are not scalable. This means that as more and more users join the network,

How Brands Can Utilize The Blockchain

Luxury brands have been plagued with counterfeit products and fake goods for decades. The rise of e-commerce has only exacerbated this problem, as it is

How To Avoid Confirmation Bias When Researching Cryptocurrencies

A psychological mistake that many people make when researching cryptocurrencies is confirmation bias. This occurs when a person looks for and interprets information in a

What Are Privacy Coins and How Do They Protect Your Identity?

As the growing concern about privacy online continues to be a hot topic, many people are turning to privacy coins as a way to keep

Will Crypto Become An Accepted Form of Currency?

Although more and more businesses are beginning to accept cryptocurrencies as a form of payment, there is still much debate surrounding whether or not they