If you are considering day trading cryptocurrencies, it is important to understand the pros and cons of this type of investing. Day trading can be a profitable way to make money but also comes with risks that should be considered before getting involved. Whether you are new to the cryptocurrency market or a seasoned investor, this guide will provide you with an overview of the advantages and disadvantages of day trading cryptocurrencies.

The Pros of Day Trading Crypto Currencies

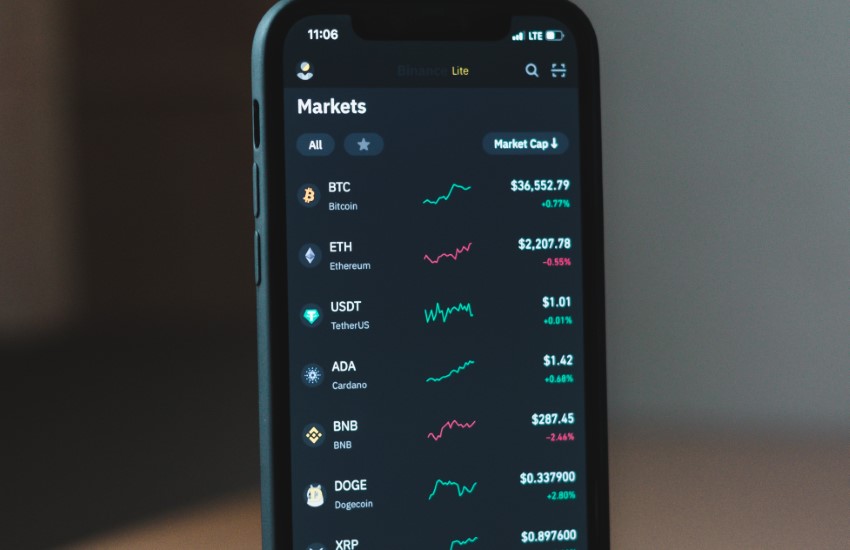

First, the cryptocurrency market is incredibly volatile and provides ample opportunity to make profits quickly. Prices can move dramatically in a short amount of time, making it possible to buy and sell for huge returns. Additionally, many cryptocurrency exchanges provide leverage options that allow traders to increase their profits even further.

Day trading cryptocurrencies can also be done from anywhere with an internet connection. This means that you don’t have to be tied down to a single location to trade. If living a lifestyle where you’d like to travel while still earning an income, this could be a great option for you. With a day trading strategy, you are always in control of your trading decisions. This means that you can tailor your approach to the markets and make adjustments as needed.

Finally, the entry fees are generally affordable and not as expensive as those of traditional stock markets. This makes it easier to start day trading cryptocurrencies even if you don’t have a lot of capital to invest. With lower-priced investments, traders can take more risks and try out new strategies without fear of losing too much money.

The Cons of Day Trading Crypto CurrenciesOne of the biggest negatives related to day trading cryptocurrencies is the potential for large losses. As with any market, prices can move suddenly in an unexpected direction, resulting in significant losses. Fees and taxes can also quickly add up if a trader isn’t careful.

Furthermore, the cryptocurrency market is still relatively new and largely unregulated. This means that there are no guarantees about the safety of your investments. Rugpulls and scams are common in the space, so it is important to do your research before investing. Although pump-and-dump schemes do happen in traditional asset markets, the risk is much higher in the crypto space due to its lack of regulation.

Finally, day trading requires dedication and discipline to consistently make profits. Missing out on key trading moments can result in missed opportunities and losses. Additionally, the time it takes to research and analyze the markets and make trades can be quite demanding.

Conclusion

If you are keen on day trading, using a free crypto portfolio tracker is a good way to get started. Moonrig.io enables users to monitor crypto in real time. As a day trader, being able to receive instant crypto notifications from your portfolio and keep up with market news will help you make better trading decisions.